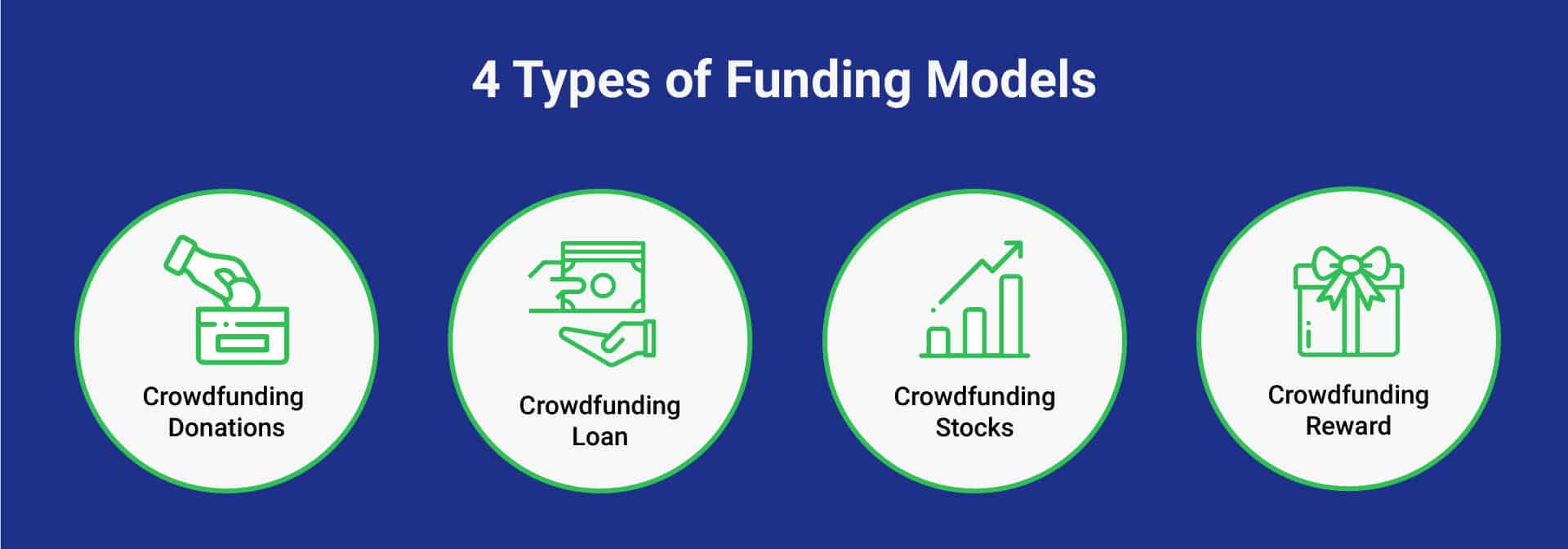

Types of Crowdfunding

A distinction is made between 4 types of crowdfunding.

1. Crowdfunding Donations

Donation Crowdfunding is probably the best-known form of crowdfunding. Usually they raise money for social causes, such as expensive medical procedures or associations. Donations don’t give investors a return, it’s a pure gift. In Europe there are several platforms that offer this service, including Crowdfunding Platform WhyDonate.

Crowdfunding for Charities

Crowdfunding for charities can be a successful way of fundraising. More and more donors prefer to give ad hoc instead of monthly. The urgency of crowdfunding for a good cause is very high and that can lead to large donations and a lot of visibility of the campaign. Social media and crowdfunding go very well together.

Do you want to easily raise money for charity? Start a free fundraiser page on WhyDonate. With a crowdfunding fundraiser on WhyDonate, you receive donations from your network and around it. Your fundraiser will be online in minutes!

View more Crowdfunding Charity tips and examples here.

Personal Crowdfunding

Apart from organisations, individuals can also raise money through crowdfunding. More and more individuals receive loans, donations and corporate financing and mortgages through private crowdfunding. It is often difficult to get a loan from a bank, which is why crowdfunding can be a solution. Even when you are short on cash or need a huge amount for medical treatment abroad, setting up a private donation crowdfunding campaign is easy and free of charge on WhyDonate.

2. Crowdfunding Loan

The fastest-growing form of crowdfunding is the loan form, which is used to finance SMEs. This form represents 89% of all crowdfunding in the Netherlands. In exchange for a loan of money, investors receive a financial reward. Sometimes they also receive an incentive.

3. Crowdfunding Equity

In equity crowdfunding, the company makes investors co-owners of the company. Sometimes literally because it directly issues shares.

If it is difficult to properly value shares, for example, when turnover or profit is still difficult to predict, a company can first issue a convertible and later convert it into shares.

Crowdfunding in shares makes the investors co-owner of the company. It is, therefore, also referred to as crowdfunding in venture capital.

In Europe, equity crowdfunding is less popular than the loan or donation variant, but it has some interesting advantages.

4. Reward-Based Crowdfunding

The main difference between donations and crowdfunding as a reward is that in the latter form, investors receive non-financial rewards from entrepreneurs. This usually applies to projects in creative departments or start-ups. In return, this can be a concert ticket or a copy of a CD. Investors can also receive a copy of the product (yet to be designed) and receive a certain amount of sponsorship.