Table of Contents

What is a Donation Receipt?

A donation receipt is a form of communication that a donor can use to formally acknowledge a gift. They serve as a form of acknowledgment that lets the donor know that their gift has been received. A donation receipt is a vital step that donors can use to claim charitable deductions on their tax returns.

Most non-profits, charities, or bigger organizations involve themselves in charitable activities, which is why they require a receipt as proof of expenditure, which helps them during taxation. Individuals also need the documentation when it comes to philanthropic activities for tax declarations.

Are Donation Receipts Necessary?

A donation receipt is an important document that details a person’s gift to an organization. It serves as a record of the transaction, keeps track of donations and can be used for tax purposes. If your organization has a recurring donation program, it is better to include details about the organization’s recent activities to make the recipient feel connected to the cause.

It’s also important for organizations to provide a receipt of donations to their donors. Most of the time, people expect to receive a receipt after making a donation. Basically, a donation receipt is very beneficial to both the organization and the donors. They can help reduce your tax liability.

While receipting is a vital part of an organization’s operations, it also serves as an opportunity to show gratitude to donors. Having a good receipting system also helps keep track of all the donations that were made.

Types of Charitable Donations Receipts

- Charity Donation Receipt: A charitable donation receipt is a letter or email that a donor receives after a gift has been received.

- Cash Donation Receipt: Cash donation receipts are provided in case donations are made in the form of cash. If the identity of the donor is available, then the donation can be called anonymous. However, if the amount is received in cash, then the donation can be considered anonymous.

- In-Kind Donation Receipt: In-kind donations are tax-deductible as long as the goods are of equal or greater value. They can also be used for volunteer work and are not tax-deductible. The recipient should also include the details of the gift in the donation receipt.

- Auction Donation Receipt: In auctions, there are 2 types of donation receipts issued, i.e., receipts for items donated and receipts for items bought. In cases of item donations, a receipt can be issued for the fair market value of the goods or services provided. For items bought at an auction, the fair market value must be established before the event.

What is a Donation Receipt Templates?

Regardless of the type of charity that you work with, your receipt needs to contain basic information to ensure that it is useful to donors. This is especially important when it comes to fundraising. Having a standard non profit donation receipt template for receipting is a good idea to ensure that you never miss important details. It also helps keep the donor experience better. Also, make sure that the receipt includes a thank-you message is important to keep the message simple and uplifting.

- Name of the organization to which the donation has been made;

- A confirmation of the registration of the organization

- Name of the Donor

- Date of donation received

- Type of donation (cash, kind, goods)

- Amount of donation

- A statement that clearly states that the organization did not provide goods or services in return for the donation.

- Name and Signature of the donor and the organization that received the donation

Pro Tip: Use a charitable donation receipt template with your nonprofit’s branding for professionalism.

Cash Donation Receipt Format

For cash donations, the receipt must include:

- “Cash Donation” clearly stated

- Donor’s signature (if collected in person)

- No goods/services provided disclaimer

Example:

“Thank you for your cash donation of $100 on 15/10/2024. No goods or services were exchanged for this contribution.”

Best Practices While Writing Charity Receipt Template

The words receipts, donors, and non-profits sound very conventional and easy to understand. But when it comes to implementing a document that can be helpful for legal activities, it needs special attention. So, here are some of the tips and tricks that can help you draft a simple yet effective donation receipt for your organization.

1. Make it clean

It is essential to have a receipt with very easy and simple data, and the cleaner the receipt will look, the more clarity people will have. A simple receipt will depict clear messages with absolutely no hidden activities. You can also keep a donation receipt template ready, which can be helpful and easy to manage.

2. Give the donor a basic idea

Donors should know how much of the donation is tax-deductible. If you’re giving away a gift or service in exchange for a donation, the value of this will need to be added to the total amount donated to your organization.

3. Provide all your details to the donor before making the donation

Think about including some background details about your organization and your mission. This can be important for the donor and can help them feel included, and it may encourage repeat donations.

4. Donation Management Software

A good donor database is an essential part of any organization. With the help of donation management software, you can easily organize and maintain all the information about donors and their donations. As much data tends to get lost during communication, donor management software can be the single point of the database to refer to.

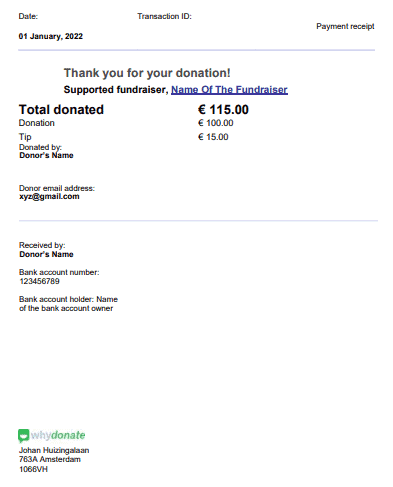

Charity Donation Receipt Example

We at WhyDonate always adhere to the best policies when it comes to donation receipts. WhyDonate’s donation platform generates receipts automatically, sends them to the donors and shows them in the fundraiser organizer’s dashboard, making it completely hassle-free. Feel free to use this as a charitable donation receipt template:

Getting the proper documentation for your charitable organization is very important. Make sure that you’re aware of the requirements for your country when it comes to sending out donation receipts. Having the necessary information will help your donors feel valued and safe. Now, you are all set and ready to draft your donation receipt with our nonprofit donation receipt template.

WhyDonate is one of the most versatile global crowdfunding platforms, and it does everything by the books. It is one of the best fundraising platforms for nonprofits that are affordable and equipped with many features like global fundraising, task automation, donation plugins, and donation receipts, all under one roof, so that you don’t have to worry about anything other than your fundraising goals. Start your fundraiser right away!

Digital vs. Printed Donation Receipts: Key Considerations

Nonprofits should weigh the benefits of digital (email) receipts and printed (physical) receipts to determine the best approach for their donors. Digital receipts offer speed, cost savings, and environmental benefits, making them ideal for online donations and recurring contributors. Platforms like WhyDonate automate the process, ensuring instant delivery and secure record-keeping.

On the other hand, printed receipts provide a personal touch for major donors, in-person events, or supporters who prefer tangible documentation. To maximize donor satisfaction, nonprofits should consider offering both options, allowing contributors to choose their preferred format during the donation process. This flexibility ensures compliance, enhances donor relationships, and accommodates varying preferences across different demographics.

FAQs

1. Is a donation receipt required for cash donations?

Yes! A cash donation receipt is crucial for IRS/HRMC compliance. Even small cash gifts need documentation if the donor requests it.

2. How to create a UK charity donation receipt?

Use a charity donation receipt template UK with:

- Charity Commission number

- Gift Aid eligibility info

- Amount in GBP

3. What are the IRS rules on donation receipts?

The IRS requires receipts for:

- Any single donation of $250+ (must acknowledge donation and state whether any goods/services were provided)

- Non-cash donations worth $500+

- Vehicle donations (special rules apply)

- All donations if claiming itemized deductions

Receipts must be contemporaneous (received by donor before filing taxes or due date of return).

4. What triggers an IRS audit on charitable donations?

Red flags include:

- Disproportionately high donations relative to income

- Non-cash donations valued at $5,000+ without proper appraisal

- Consistently rounding donation amounts

- Claiming donations to non-501(c)(3) organizations

- Sudden large increases in charitable giving

- Lack of proper documentation for significant donations

5. Can I claim donations without a receipt?

For donations under

250:You may claim them without a receipt, but need bank records or other reliable documentation.

For250+: IRS requires written acknowledgment from the charity. No receipt = no deduction if audited.

6. Do I need to pay tax on donations received?

Nonprofits: Generally, no tax on donations if you’re a 501(c)(3). Must file Form 990.

Donors: No tax on money/goods you give, but you may get tax deductions if you itemize.

7. What happens if I don’t keep receipts for charitable donations and I get audited?

Without proper documentation:

- IRS may disallow all charitable deductions

- You could owe back taxes plus penalties/interest

- For significant discrepancies, could face accuracy-related penalties (20% of underpayment)

- May need to provide alternative proof (bank statements, charity records)

Protect yourself: Keep receipts for 3-7 years (depending on donation amount) and maintain organized records. Digital tools like WhyDonate automatically generate and store donation receipts for easy access.